boulder co sales tax efile

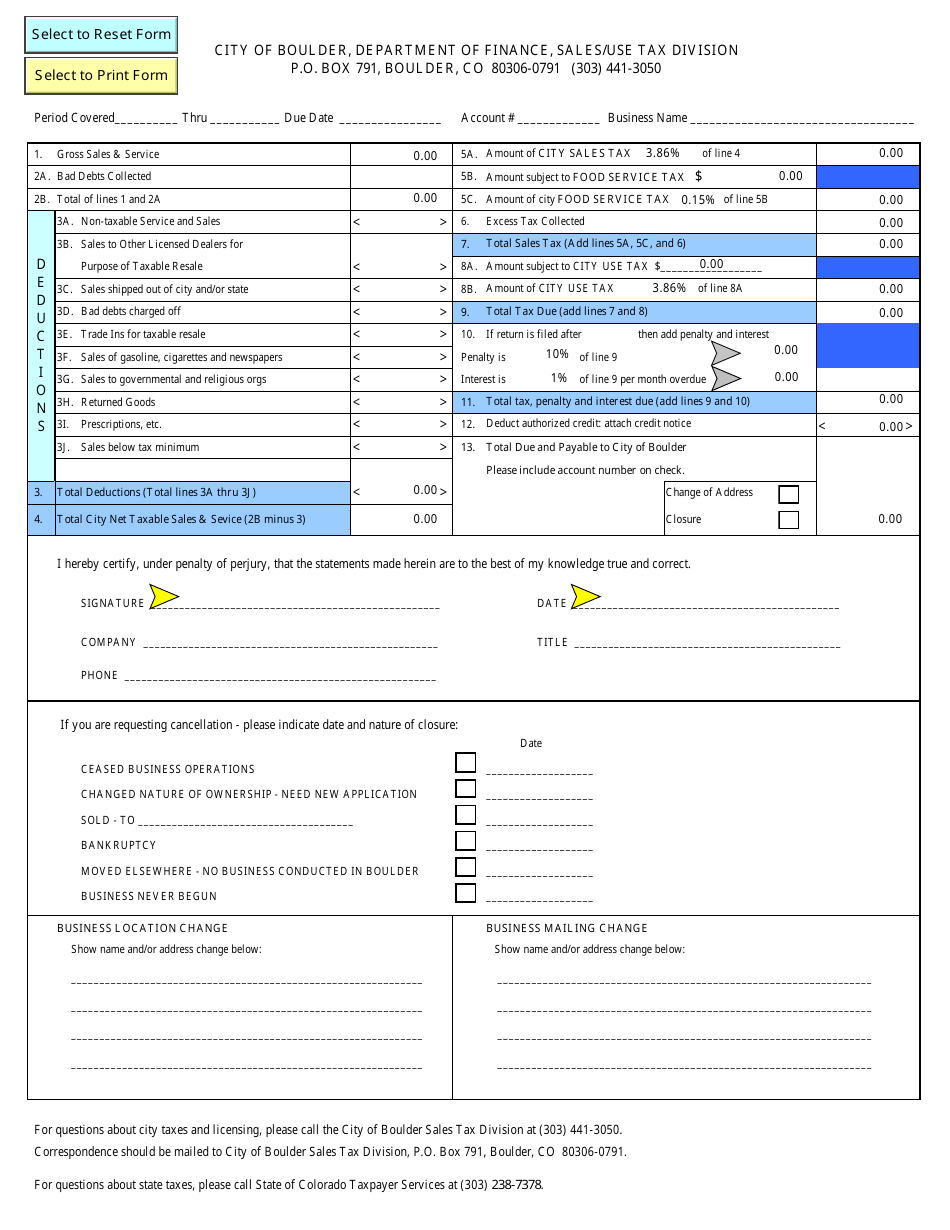

Sales tax licenses are required from both the city and state for businesses to operate in the City of Boulder. If you filed online or with a tax software and want to pay by check or money order.

Bcor 2206 Economics Of Waiting Lines Operations Management Economics Management

There is a one-time processing fee of 25 which may be.

. Colorado has a 29 sales tax and Boulder County collects an additional. 350 Homemade trailer ID. Ad Avalara Returns for Small Business can automate the sales tax filing process.

This is the total of state county and city sales tax rates. 720 Title print only. The Colorado sales tax rate is currently.

Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys Sales. Between 2009 and 2019 sales tax revenues in the city had steadily increased with the exception of a flattening between 2016 and 2017. Sales tax returns may be filed annually.

The COVID-19 pandemic resulted in significant. PdfFiller allows users to edit sign fill and share all type of documents online. Start your 60-Day Free Trial plus get 5 Free Filings.

State of Colorado Boulder County and RTD taxes are remitted to the State of. The minimum combined 2022 sales tax rate for Boulder County Colorado is. Annual returns are due January 20.

If you need additional assistance. Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. Mobile Home Tax Lien Sale.

820 Duplicate title. The minimum combined 2022 sales tax rate for Boulder Colorado is. The current total local sales tax rate in Boulder CO is 4985.

Navigating the Boulder Online Tax System. There are a few ways to e-file sales tax returns. The current total local sales tax rate in Boulder County CO is 4985.

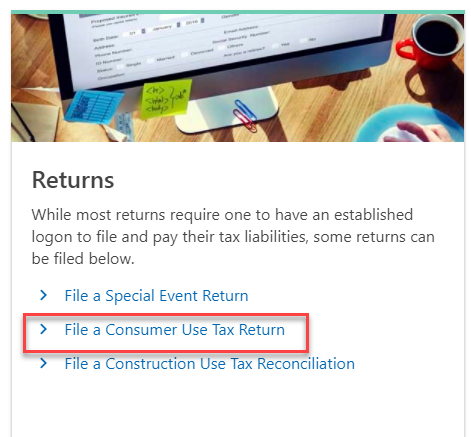

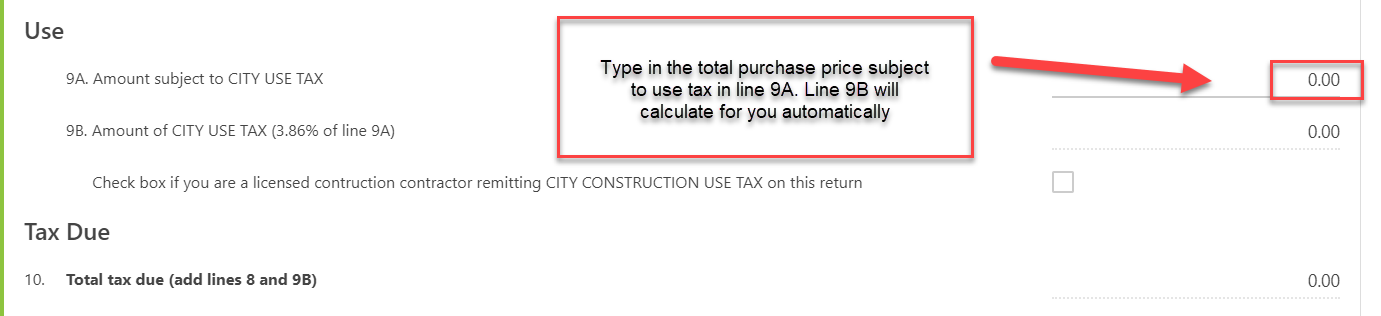

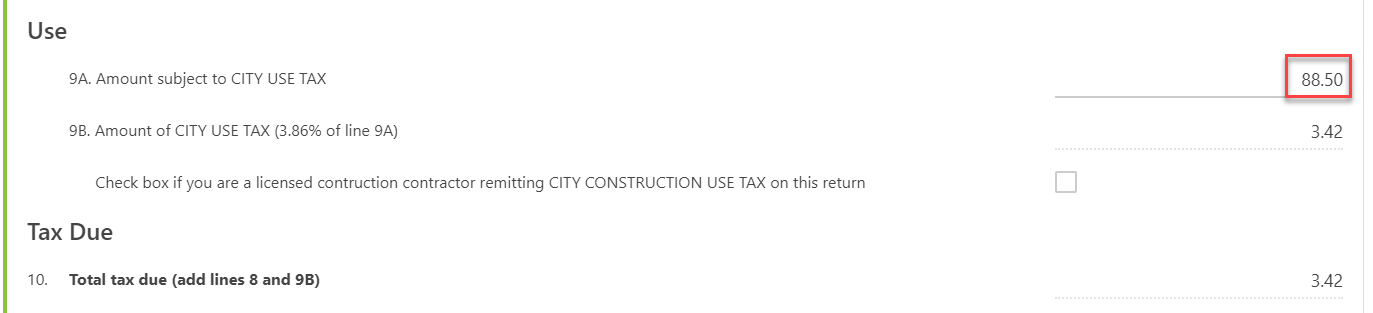

Construction Use Tax is the salesuse tax paid by contractors or homeowners for construction materials used when erecting building remodeling or repairing real property. The total sales tax rate in any given location can be broken down into state county city and special district rates. Make the check or money order payable to the Colorado Department of Revenue.

Our tax lien sale will be held Friday December. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. 428 Year and Month.

For tax rates in other cities see Colorado sales taxes by city and county. Filing frequency is determined by the amount of sales tax collected monthly. 417 Year Tab Replacement.

The December 2020 total local sales tax rate was 8845. E-File Your Tax Return Online - Here. 400 Duplicate registration.

Access and find resources about the Boulder Online Tax System below including how-to videos and PDF guides. Proposed Sales Tax Extension. What is the sales tax rate in Boulder County.

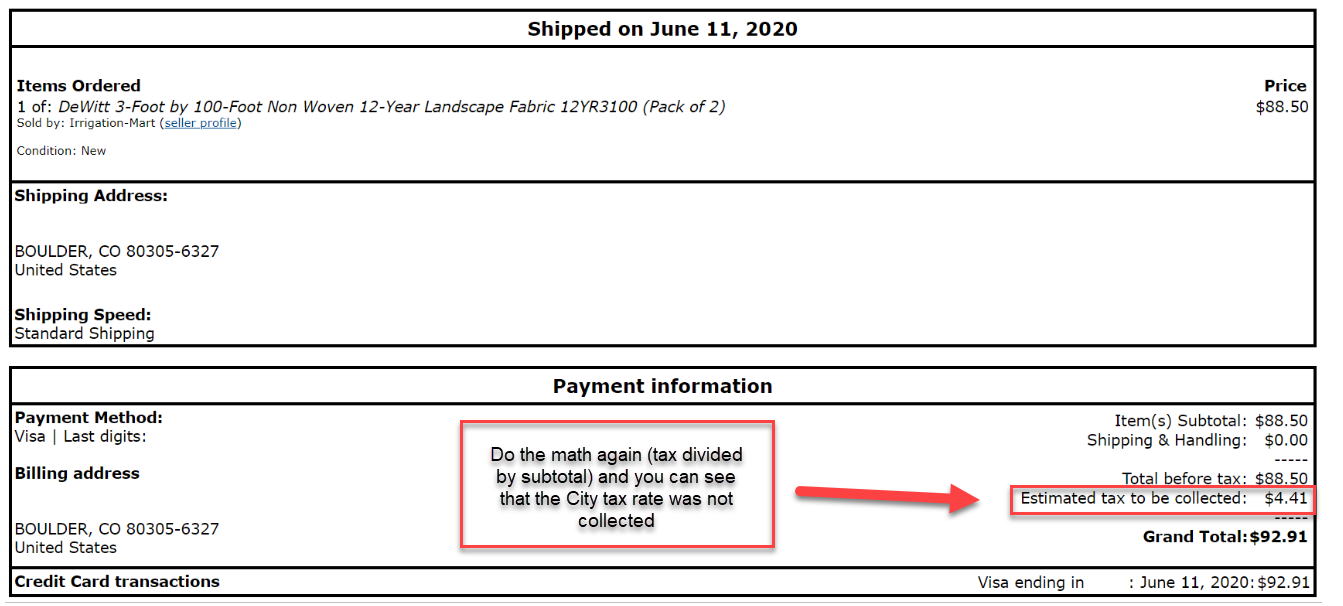

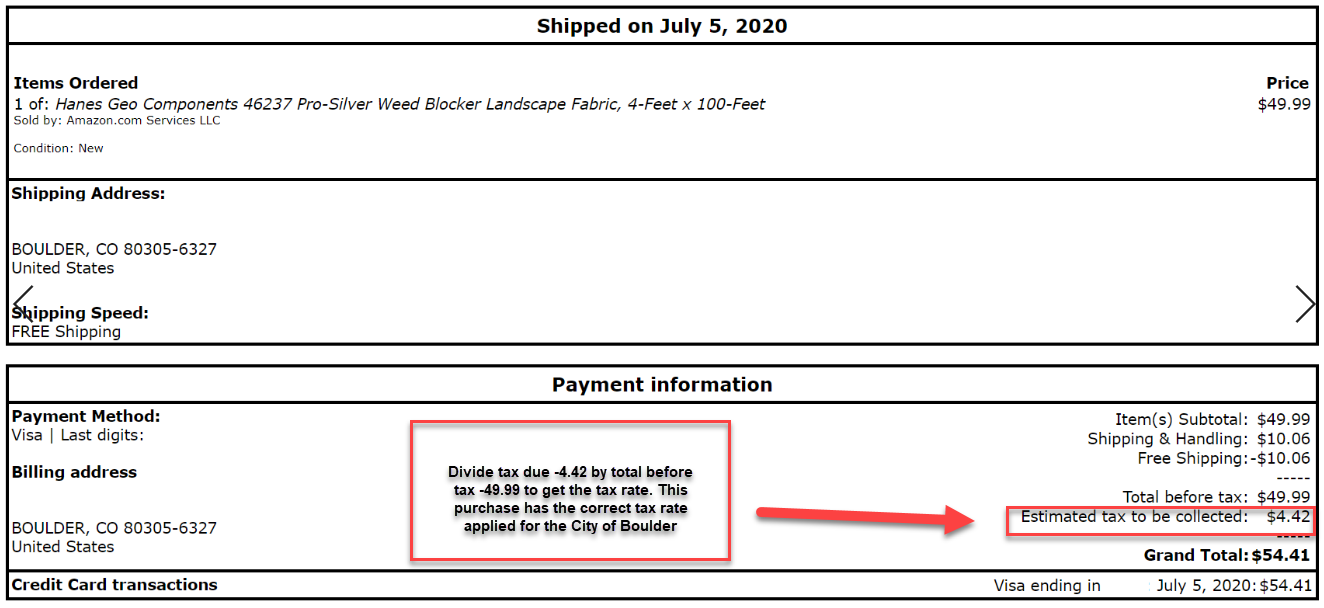

The current 01 Transportation Sales Tax expires June 30 2024. In the example below the full tax rate has been. Sent direct messages to.

The December 2020 total local sales tax rate was also 4985. On August 4 the the Boulder County Board of County Commissioners BOCC approved asking. Our tax lien sale will be held Wednesday November 16 2022 Registration begins at 730 AM Sale begins at 830 AM.

The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans. This is the total of state and county sales tax rates. Return the completed form in person 8-5 M-F or by mail.

Payment After Filing Online. 15 or less per month. The Boulder County Sales Tax is 0985.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Check those invoices and receipts to ensure that the full tax rate City County RTD State of 8845 has been assessed and collected.

Co Dept Of Revenue Co Revenue Twitter

Consumer Use Tax How To File Online Department Of Revenue Taxation

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales And Use Tax City Of Boulder

File Sales Tax Online Department Of Revenue Taxation

Tax Accountant For U S Expats International Taxpayers Us Tax Help

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

File Sales Tax Online Department Of Revenue Taxation

File Sales Tax Online Department Of Revenue Taxation

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Sales Tax Campus Controller S Office University Of Colorado Boulder